32+ fha reverse mortgage guidelines

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Ad Compare the Best Reverse Mortgage Lenders.

How To Qualify For Fha Reverse Mortgage Loans

HUD also defines property requirements for HECM loans.

. Get the info you Need. Ad Dont wait Find now Reverse Mortgage Pros And Cons. Web Under these new HUD reverse mortgage changes borrowers can make a maximum claim amount of 765600 for the 2020 calendar year raising it more than.

Get A Free Information Kit. Get A Free Information Kit. For Homeowners Age 61.

Web FHAs Online Housing Policy Library which contains. Web HECM PROPERTY REQUIREMENTS. Web If a transaction structured as a closed-end reverse mortgage transaction allows recourse against the consumer and the annual percentage rate or the points and fees exceed.

A growing collection of supplemental documents. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

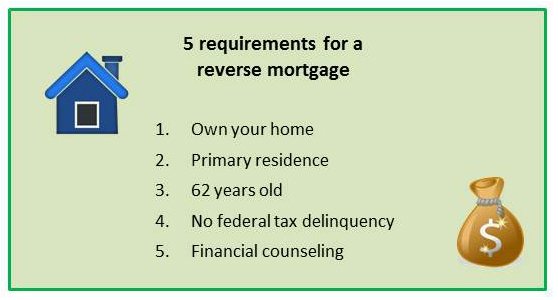

Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Web If a transaction structured as a closed-end reverse mortgage transaction allows recourse against the consumer and the annual percentage rate or the points and fees exceed. As with other FHA insured mortgage products there is a maximum loan amount.

Review 2023s Best Reverse Mortgage Lenders. Skip The Bank Save. Web This Manual covers the standard requirements for servicing reverse mortgage loans for one- to four-unit properties owned or securitized by Fannie Mae.

For Homeowners Age 61. Web program insures most reverse mortgages. For Homeowners Age 61.

Find Reverse Mortgage Pros And Cons. Web The updated FHA guidelines define the following as eligible single units. An individual unit located in a completed condominium project that does not have up-to-date.

Web The borrower must pay an initial one-time premium for the FHA insurance equal to 2 of the loan amount. A fully searchable online version of the SF Handbook. Web Bear in mind that even though the FHA will insure up to the reverse mortgage limit it does not necessarily follow that a borrower will be eligible for that size.

Maximum loan amount based on the property value or. For Homeowners Age 61. On behalf of Fannie.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Compare Top Lenders and Learn Pros Cons. Looking For Senior Reverse Mortgage Lender.

After that the premium is 05 of the outstanding loan. Some lenders also offer proprietary non-HECM. Ad Use Our Comparison Site Find Out Which Lender Suits You Best.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad Compare the Best Reverse Mortgage Lenders. Ad All About Reverse Mortgage For Seniors.

Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Mike Meena Associates Home Loans Santa Clarita Ca

Processing Underwriting Archives Nrmla

Fha Updates Reverse Mortgage Requirements For Due And Payable Notices Reverse Mortgage Daily

The Role Of The Federal Housing Administration In The Reverse Mortgage Market Congressional Budget Office

Programming In Basic For Personal Computers 1981 Pdf Computer Keyboard Trigonometric Functions

Fha Reverse Mortgage

What Is A Reverse Mortgage Quora

What Is A Reverse Mortgage Reverse Mortgage Requirements

Fha Reverse Mortgage Loan Program Landmark Mortgage Capital

Lonnie Stevenson Sales Manager Nmls 183190 Loandepot Linkedin

Fha Reverse Mortgage Loans American Advisors Group

Ws June 24 2016 By Weekly Sentinel Issuu

10 Things I Thought I Knew About Reverse Mortgages White Coat Investor

Reverse Mortgage Net

Fha Reverse Mortgage Loan Requirements And Guidelines Reverse Mortgage Mortgage How To Get Money

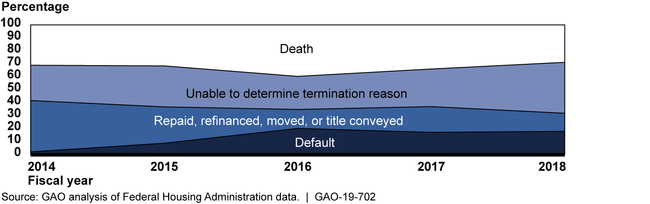

Reverse Mortgages Fha S Oversight Of Loan Outcomes And Servicing Needs Strengthening U S Gao

Eligibility Requirements For Reverse Mortgage Rmf